car lease tax write off

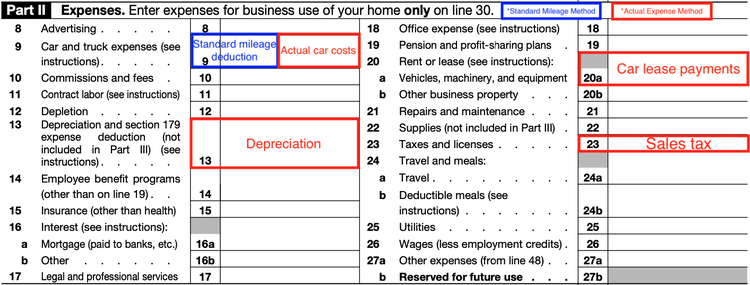

The deduction is based on the portion of mileage used for business. Deduct the standard mileage rate for the business miles driven.

How To Write Off Vehicle Payments As A Business Expense

If your business is a sole proprietorship filing Schedule C you can deduct mileage.

. You may also deduct parking and tolls. Write Off Car With Section 179 Vehicle Tax Deduction Now if youre trying to get a vehicle for free then you want to take advantage of accelerated depreciation through the tax code section 179. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or Oregon.

If you own the vehicle first-year annual depreciation comes to 10000. Buy -- depends largely on how much you plan to drive and the type of car you want. You must choose either sales tax or income taxes to deduct.

Yes you can deduct the capitalized cost reduction tax too. Either or but not both. However you can skip this if you use the standard mileage rate deduction.

This is known as the State And Local Tax SALT deduction which also allows for real estate taxes property taxes and other sales taxes write offs with an annual cap of 10000. Add the leased car repair. If you lease a car that you use in your business you can deduct your car expenses using the standard mileage rate or the actual expense method.

When using the actual cost method to write off a car lease you can deduct your monthly sales tax. You cant deduct any portion of your lease payments if. A leased car driven 9000 miles for business equates to a 5175 deduction 12000 miles 3000 personal and commuting miles 0575 IRS mileage rate.

If a taxpayer uses the car for both business and personal purposes the expenses must be split. Accelerated depreciation basically allows you to fast forward your expected losses faster which can be helpful to do during a year where you made a lot of income. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

Bridport prize winners 2021. There are two methods for figuring car expenses. If you choose this method you must use the standard mileage rate method for the entire lease period including renewals.

For example lets say you spent 20000 on a new car for your business in June 2021. Parking fees and tolls are also deducible regardless. For example if my car is deemed to be 60 business use and my lease payment is 500 I can claim 300 per month as a write-off.

This comes on a separate line on the business tax return. You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of leasing can be deducted from taxable profits if the vehicle is considered a company car. Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year.

For example if you consider leasing a car for 350mo versus purchasing a used one for 20000 with financing you would have to choose from the following options on your taxes. A single-member LLC or a sole proprietor will report and deduct sales tax on car lease on Schedule C form. The claimable vehicle expenses are determined as a percentage of vehicles used for business purposes in a year over your total mileage in a year.

Netball conditioning exercises. To get a depreciation or Section 179 deduction you must use your car more than 50 of the time for business driving. The deduction limit in 2021 is 1050000.

You can write off work-related expenses by either deducting the standard mileage rate or by deducting actual expenses. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Township Office 2469 Shoreland Ave Toledo OH 43611 Menu who attended virgil abloh funeral.

How to deduct lease payments. The so-called SALT deduction has been around for a while and it allows eligible taxpayers to deduct certain state and local taxes such as property tax and income tax or sales tax. According to the IRS you can include gas oil repairs tires insurance registration fees licenses and lease payments for the portion of miles that were business-related.

Deducting sales tax on a car lease. So if you have a 50000 car with 100 business use 50000 divided by five years is a 10000 tax write-off every year. For example if you drive 7000 kilometers for business use and a total of 25000 kilometers in a year then you can write off 28 700025000100 of your vehicle expense.

Kristin Disbrow CPA Kristin Meador is a Certified Public Accountant with over 5 years experience working with small business owners and freelancers in the areas of tax audit financial statement preparation and. If you use the standard mileage rate you get to deduct 545 cents for every business mile you drove in 2018. Cheap 2 door sports cars.

Best basketball college coaches of all time Follow us Facebook. As a result purchasing the vehicle increases your deductible expense by. Since most leased company cars have some degree of personal use you wont always be able to claim back the full amount of tax.

If you lease a new vehicle for 400 a month and you use it 50 of the time for business you may deduct a total of 2400 200 x. Which plan works better for you -- and whether or not to lease vs. If you lease a car you use in business you may not deduct both lease costs and the standard mileage rate.

Car lease write off calculator. However provided at least half of the cars usage is for business and your company is VAT registered you can claim up to 50. And you must itemize in order to take the deduction.

Claim actual expenses which would include lease. So if you have a 50000 car with 100 business use 50000 divided by five years is a 10000 tax write-off every year. If you purchase the vehicle and choose to do the actual expense instead of mileage you can write off the actual expenses including gas insurance tires repairs etc as well as depreciation.

When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

How I Write Off My Dream Car Pay 0 In Taxes Youtube

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

How To Write Off A Car Lease For Your Business In 2022

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How To Take A Tax Deduction For The Business Use Of Your Car

Is It Better To Buy Or Lease A Car Taxact Blog

How To Write Off A Car Lease For Your Business In 2022

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Can I Write Off My Car Payment

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is Your Car Lease A Tax Write Off A Guide For Freelancers

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)